The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer.

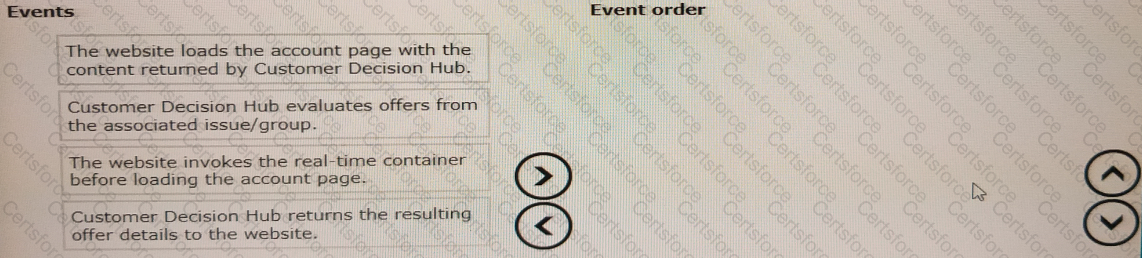

Place the events in the sequential order.

To reference a customer property in a strategy, you need to prefix the property name with the keyword______________.

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer to the qualified customers on its website. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning consultant, you are now expected to make the remaining configurations in the Next-Best-Action Designer's Channel tab to enable the website to communicate with the Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you perform in the Next-Best-Action Designer's Channel tab? (Choose Two)

As a Decisioning consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which statement is true when the simulation scope is: Audience simulation with engagement policy and arbitration?

Reference module: Next-Best-Action in an omnichannel environment

A bank uses Pega Customer Service in its contact center. When a call comes in, it is routed to a service representative. Once the service representative accepts the call, the Customer Decision Hub (CDH) determines the Next-Best-Action to be offered to the customer. What two pieces of information is used by the Customer Decision Hub to determine the Next-Best-Action recommendations? (Choose Two)

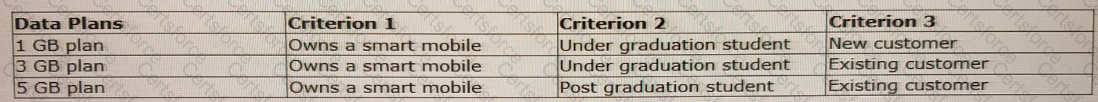

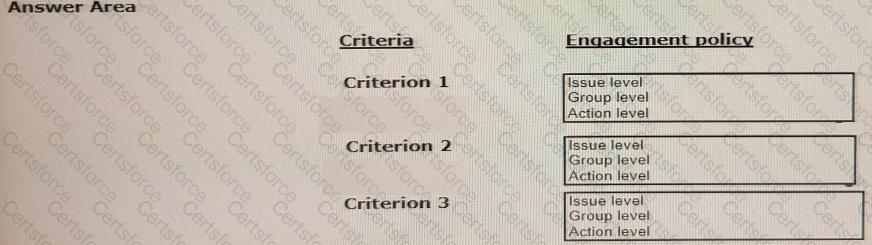

Myco, a telecom company, has come up with a new data plan group to suit its customers' needs. The below table lists the three data plan actions and the criteria a customer should satisfy to qualify for the offer.

How do you configure the engagement policies to implement this requirement?

A bank wants to add a contact policy that will suppress an action for 20 days if it was rejected twice in any channel in the last 30 days. How do you define the suppression rule for the contact policy?

In an organization, customer actions are applicable to various business issues. What is the best way to organize them?

A bank wants to present the Rewards Card offer on the top right of the customers’ account page when they log in. Select the placement type of the treatment design.

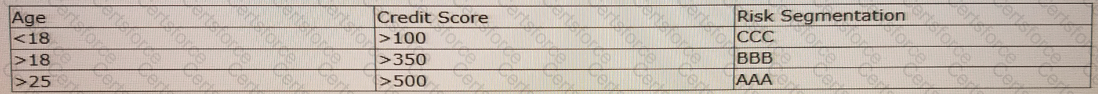

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning consultant, how do you implement the business requirement?