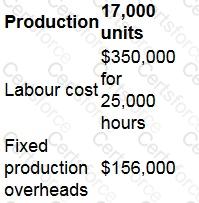

The standard production cost of making a product is as follows:

What is the fixed production overhead capacity variance?

Which TWO of the following statements are true for obtaining a reliable forecast from a time series?

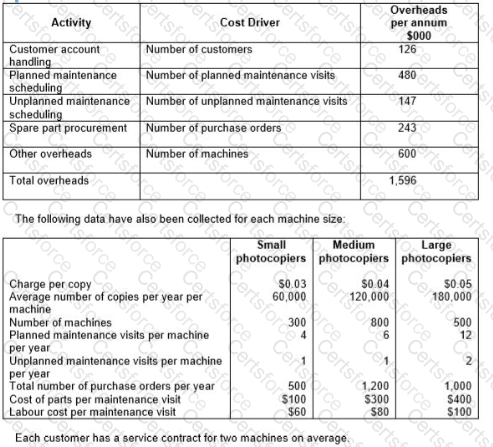

A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

The company’s existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department’s support activities to each size of machine. The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company’s accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine, using the current basis for charging the costs of support activities to machines.

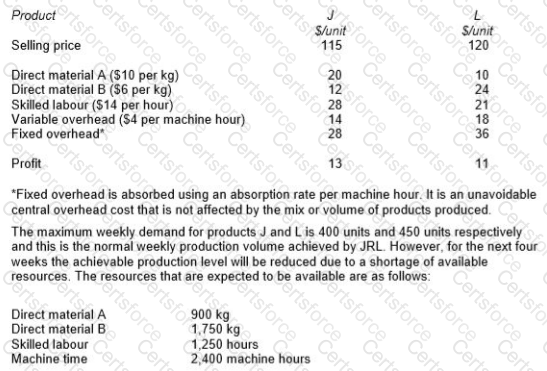

JRL manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

The optimal solution in the previous question shows that the shadow prices of skilled labour and direct material A are as follows:

Skilled labour $ Nil

Direct material A $11.70

Explain the relevance of these values to the management of JRL.

What is the additional contribution that can be earned?

Which of the following, regarding costing methods, is true?

RFT, an engineering company, has been asked to provide a quotation for a contract to build a new engine. The potential customer is not a current customer of RFT, but the directors of RFT are keen to try and win the contract as they believe that this may lead to more contracts in the future. As a result, they intend pricing the contract using relevant costs. The following information has been obtained from a two-hour meeting that the Production Director of RFT had with the potential customer. The Production Director is paid an annual salary equivalent to $1,200 per 8-hour day. 110 square meters of material A will be required. This is a material that is regularly used by RFT and there are 200 square meters currently in inventory. These were bought at a cost of $12 per square meter. They have a resale value of $10.50 per square meter and their current replacement cost is $12.50 per square meter. 30 liters of material B will be required. This material will have to be purchased for the contract because it is not otherwise used by RFT. The minimum order quantity from the supplier is 40 liters at a cost of $9 per liter. RFT does not expect to have any use for any of this material that remains after this contract is completed. 60 components will be required. These will be purchased from HY. The purchase price is $50 per component. A total of 235 direct labour hours will be required. The current wage rate for the appropriate grade of direct labour is $11 per hour. Currently RFT has 75 direct labour hours of spare capacity at this grade that is being paid under a guaranteed wage agreement. The additional hours would need to be obtained by either (i) overtime at a total cost of $14 per hour; or (ii) recruiting temporary staff at a cost of $12 per hour. However, if temporary staff are used they will not be as experienced as RFT’s existing workers and will require 10 hours supervision by an existing supervisor who would be paid overtime at a cost of $18 per hour for this work. 25 machine hours will be required. The machine to be used is already leased for a weekly leasing cost of $600. It has a capacity of 40 hours per week. The machine has sufficient available capacity for the contract to be completed. The variable running cost of the machine is $7 per hour. The company absorbs its fixed overhead costs using an absorption rate of $20 per direct labour hour.

Select ALL the true statements.

A company produces and sells more than one product.

All products are manufactured using the same facilities and incur common fixed costs.

Which of the following is used to calculate the break-even sales revenue for the business?

The simplex method has been used to determine the optimum output of products P, Q, R and S with constraints on resources J, K and L.

In the final simplex tableau, the figure in the product R row and the column for slack variable K is 80.

Which of the following statements is correct?