Refer to the exhibit.

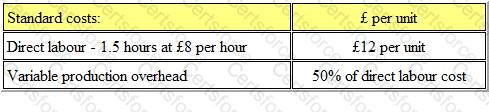

AM Ltd. makes and sells a single product for which the standard cost information is as follows:

Budgeted production for the period is 30,000 units.

The actual results for the period were as follows:

What is the variable overhead efficiency variance?

A company uses an integrated accounting system.

The accounting entries for the issue of direct materials to production would be:

Refer to the exhibit.

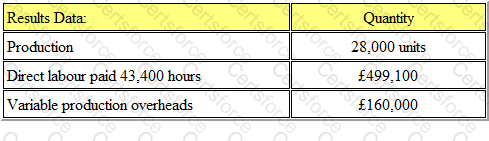

The indirect costs of a hospital's Radiology Department consists mainly of equipment related costs. Details of the budget for Period 4 are:

The most appropriate overhead absorption rate is:

Which one of the following is an advantage of placing the management accounting function within a centralized finance department?

Refer to the exhibit.

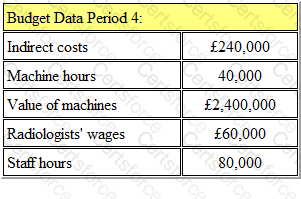

The budget for ORG for the month of September contained the following data:

During the month the actual number of units produced was 1,550. The management accounts showed a direct labour rate variance of $200 adverse and direct labour efficiency of $150 adverse.

The actual direct labour cost in the month was:

A company provides its managers with monthly budgetary control reports. Which ONE of the following types of financial information is this?

Which one of the following is an advantage of business partnering roles for the management accounting function within an organisation?

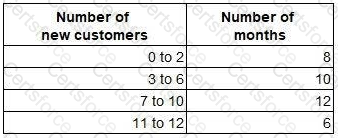

Every month for the last three years, a company has recorded the number of new customers for that month. The data have been summarised and grouped as follows:

What is the arithmetic mean of the number of new customers per month?

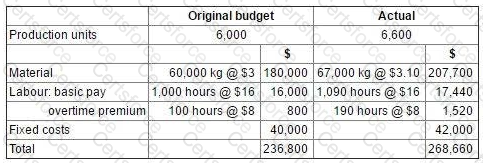

The budget and actual cost statements for the production department for the latest period were as follows.

Notes.

The 10% increase in production was required to meet unexpected additional sales demand.

The production manager is responsible for negotiating the price of materials with suppliers.

The normal working time is 900 hours per period. Any overtime worked above these 900 hours is paid at a premium of 50%.

In preparing the flexible budget for the latest period, which TWO of the following statements are correct? (Choose two.)

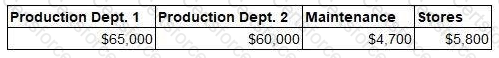

A company has two production departments and two service departments (Maintenance and Stores). The overhead costs of each of the departments are as follows.

The following equations represent the reapportionment of each of the service department overheads to the other.

M = 4,700 + 0.1S

S = 5,800 + 0.2M

Where M = total Maintenance overhead after reapportionment from Stores

S = total Stores overhead after reapportionment from Maintenance

60% of the total Maintenance overhead and 50% of the total Stores overhead are to be apportioned to Production Department 1.

The total production overhead for Production Department 1 after reapportionment of the service departments’ overhead costs is closest to: