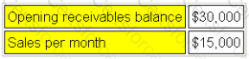

Refer to the Exhibit.

CM has produced the following budget information for next year:

The opening receivables balance represents 2 months sales. It is expected that the same level of sales will continue at an even rate throughout the year.

In an effort to improve receivables collection periods it is proposed to offer a discount of 5% for payment by cash. It is expected that 20% of customers will pay by cash. Of the remaining 80% credit sales, 40% will be settled within 1 month and 60% are expected to settle within 2 months.

What are the budgeted cash receipts from cash and credit sales in the year?

Which one of the following is NOT one of the five stated fundamental principles of CIMA's code of ethics?

Which of the following best describes a step cost?

The following costs are incurred by a company which owns a five star hotel. Which THREE of the items would normally be classified as variable costs?

It is company policy that the closing inventory of finished goods must be equal to 10% of the following month's budgeted sales. The budget sales for November and December are 8,000 and 9,000 units respectively.

The budgeted production for November will be:

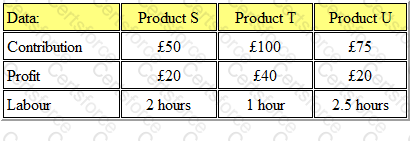

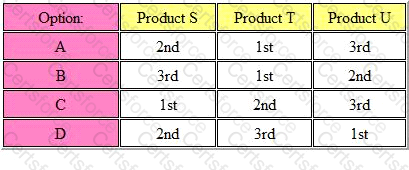

Refer to the exhibit.

C Ltd manufactures three products, which require the same type of materials. The following contribution and profit per unit is available:

In a period in which labour hours are in short supply, which of the following options is the rank order of production?

Each unit of product GM requires 4 labour hours to be produced. 25% of the units will be completed during overtime hours.

Sales of 24,000 units are planned and finished goods inventory is budgeted to rise by 2,000 units.

If the wage rate is £6 per hour and the overtime premium is 50%, what is the budgeted labour cost?

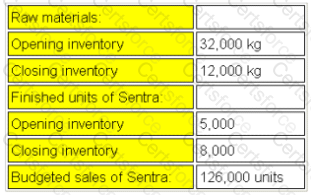

Refer to the exhibit.

The budget for product Sentra for the month of August is given below:

Each unit of Sentra requires 4kg of raw materials.

The raw materials purchases budget for the month of August is:

Xter Ltd produces product 'PZ'. The forecast sales for the forthcoming year are 50,000 units.

It is anticipated that there will be 10,000 units of opening inventory at the beginning of the year. However, management wishes to reduce this inventory by 30% by the end of next year.

The production budget for the forthcoming year will be

A company uses an integrated accounting system.

The accounting entries for depreciation of machinery used for production would be.