Whistlekleen is a national dry cleaning and laundry company with 50 shops. You are conducting a surveillance audit of the Head Office and are sampling customer complaints. 80% of complaints originate from five shops in the same region. Most of these complaints

relate to customer laundry not being cleaned as customers require. The Quality Manager tells you that these are the oldest shops in the company. The cleaning equipment needs replacing but the company cannot afford it now. You learn that the shop managers were

told to dismiss most of the complaints because of the poor quality of the laundered materials.

On raising the matter with senior management, you are told that there are plans to replace the equipment in these shops over the next five years.

You raised a nonconformity against clause 8.5.1 of ISO 9001.

Based on the scenario, select the three options which best describe the evidence for raising such a nonconformity.

You are carrying out an annual audit at an organisation that has been certificated to ISO 9001 for two years. The organisation offers home security

services. The scope of the quality management system covers alarm installation, alarm servicing, alarm monitoring and response. The business

operates from a single office and employs subcontract installers and service technicians across the country.

You have just completed the opening meeting. You are interviewing the Managing Director (MD).

You: "I would like to gain an understanding of how the quality management system has been supporting your business and its strategic direction."

MD: "We are continuing to face difficult times. The market is extremely competitive, and customers typically look for the least expensive option when

choosing home security services. We have not yet seen any business benefit from our quality management system."

You: "Tell me how you determine external and internal issues."

MD: "We use SWOT analysis (Strengths Weaknesses, Opportunities, Threats)."

You: "How have the outputs from your SWOT been used?"

Select two of the following audit trails would you take to explore the extent to which the SWOT analysis and the outputs from this

have been used to enable the business to achieve the intended results(s) of its quality management system according to ISO 9001.

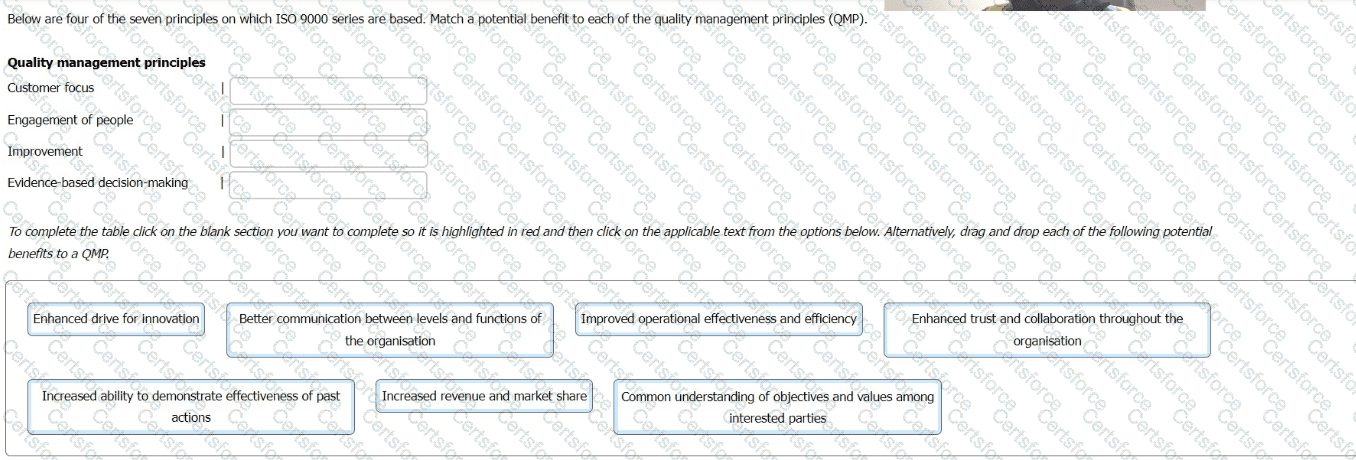

Below are four of the seven principles on which ISO 9000 series are based. Match a potential benefit to each of the quality management principles (QMP).

Scenario 1: AL-TAX is a company located in California which provides financial and accounting services. The company manages the finances of 17 companies and now is seeking to expand their business even more The CEO of AL-TAX, Liam Durham, claims that the company seeks to provide top-notch services to their clients Recently, there were a number of new companies interested in the services provided by AL-TAX.

In order to fulfill the requirements of new clients and further improve quality, Liam discussed with other top management members the idea of implementing a quality management system (QMS) based on ISO 9001. During the discussion, one of the members of the top management claimed that the size of the company was not large enough to implement a QMS. In addition, another member claimed that a QMS is not applicable for the industry in which AL TAX operates. However, as the majority of the members voted for implementing the QMS. Liam initiated the project.

Initially, Liam hired an experienced consultant to help AL-TAX with the implementation of the QMS. They started by planning and developing processes and methods for the establishment of a QMS based on ISO 9001. Furthermore, they ensured that the quality policy is appropriate to the purpose and context of AL TAX and communicated to all employees. In addition, they also tried to follow a process that enables the company to ensure that its processes are adequately resourced and managed, and that improvement opportunities are determined.

During the implementation process, Liam and the consultant focused on determining the factors that could hinder their processes from achieving the planned results and implemented some preventive actions in order to avoid potential nonconformities Six months after the implementation of the QMS. AL-TAX conducted an internal audit. The results of the internal audit revealed that the QMS was not fulfilling all requirements of ISO 9001. A serious issue was that the QMS was not fulfilling the requirements of clause 5.1.2 Customer focus and had also not ensured clear and open communication channels with suppliers.

Throughout the next three years, the company worked on improving its QMS through the PDCA cycle in the respective areas. To assess the effectiveness of the intended actions while causing minimal disruptions, they tested changes that need to be made on a smaller scale. After taking necessary actions, AL-TAX decided to apply for certification against ISO 9001.

Based on the scenario above, answer the following question:

Scenario 1 indicates that AL-TAX did not ensure clear and open communication channels with interested parties. Which quality management principle did the organization not follow in this case?

Takitup is a small fabrication organisation that manufactures steel fencing, stairs and platforms for the construction sector. It has been certified to ISO 9001 for some time and has appointed a new Quality Manager. The audit plan during a surveillance audit covers the organisation's improvement actions and the auditor asks to see the most recent management review meeting minutes.

The auditor finds that the management review report records that none of the improvement actions set by the previous review has been realised for a second time. A new Quality Manager has been brought in at the middle management level to rectify the situation as the organisation is concerned that it might lose its certification.

Select three options that would provide evidence of conformance with clause 10.3 of ISO 9001.

Scenario 1: AL-TAX is a company located in California which provides financial and accounting services. The company manages the finances of 17 companies and now is seeking to expand their business even more The CEO of AL-TAX, Liam Durham, claims that the company seeks to provide top-notch services to their clients Recently, there were a number of new companies interested in the services provided by AL-TAX.

In order to fulfill the requirements of new clients and further improve quality, Liam discussed with other top management members the idea of implementing a quality management system (QMS) based on ISO 9001. During the discussion, one of the members of the top management claimed that the size of the company was not large enough to implement a QMS. In addition, another member claimed that a QMS is not applicable for the industry in which AL TAX operates. However, as the majority of the members voted for implementing the QMS. Liam initiated the project.

Initially, Liam hired an experienced consultant to help AL-TAX with the implementation of the QMS. They started by planning and developing processes and methods for the establishment of a QMS based on ISO 9001. Furthermore, they ensured that the quality policy is appropriate to the purpose and context of AL TAX and communicated to all employees. In addition, they also tried to follow a process that enables the company to ensure that its processes are adequately resourced and managed, and that improvement opportunities are determined.

During the implementation process, Liam and the consultant focused on determining the factors that could hinder their processes from achieving the planned results and implemented some preventive actions in order to avoid potential nonconformities Six months after the implementation of the QMS. AL-TAX conducted an internal audit. The results of the internal audit revealed that the QMS was not fulfilling all requirements of ISO 9001. A serious issue was that the QMS was not fulfilling the requirements of clause 5.1.2 Customer focus and had also not ensured clear and open communication channels with suppliers.

Throughout the next three years, the company worked on improving its QMS through the PDCA cycle in the respective areas. To assess the effectiveness of the intended actions while causing minimal disruptions, they tested changes that need to be made on a smaller scale. After taking necessary actions, AL-TAX decided to apply for certification against ISO 9001.

Based on the scenario above, answer the following question:

The CEO of AL-TAX hired an experienced consultant to help with the implementation of the QMS. Is this required from ISO 9001?

You are conducting a third-party audit to ISO 9001 and interviewing the Training Manager. She explains that training is more

important than ever because the organisation has had to reduce the number of staff employed. Many of the remaining staff

are now required to be 'multi-skilled'. You ask to see plans for the multi-skilling training and are shown plans that look

comprehensive, and include both 'on the job" training and internal and external training courses.

The records indicate that several staff required parts of their training to be repeated one month after the first training was

provided. You ask why this was needed and are told that an investigation of customer complaints identified that several staff

members did not complete certain tasks in the correct manner. The extra training was therefore recommended as a

corrective action.

Based on this interview, which two of the tollowing audit trails would be the most appropriate to follow?

Select the two most appropriate audit trails from the following.

"A set of interrelated or interlacing elements of an organization to establish policies and objectives, and processes to achieve those objectives" is the definition of a/an:

According to ISO 9000, what is quality?

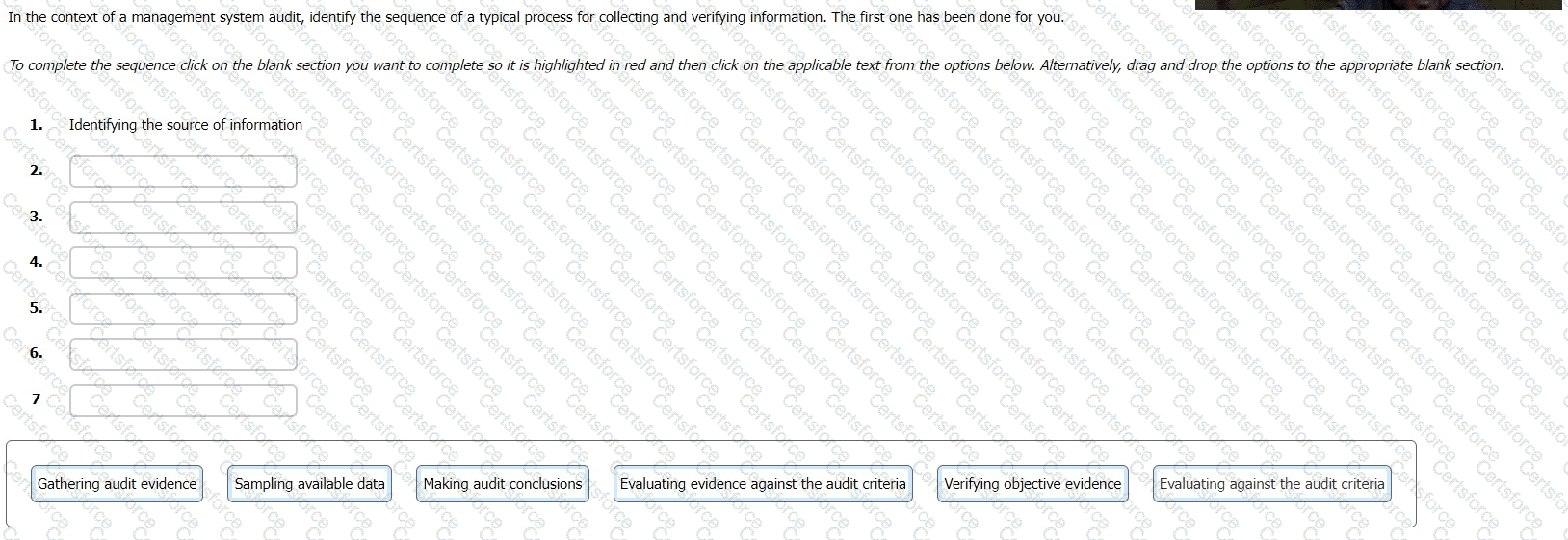

In the context of a management system audit, identify the sequence of a typical process for collecting and verifying information. The first one has been done for you.

To complete the sequence click on the blank section you want to complete so it is highlighted in red and then click on the applicable text from the options below. Alternatively, drag and drop the options to the appropriate blank section.