FG acquired 75% of the equity share capital of HI on 1 September 20X3.

On the date of acquisition, the fair value of the net assets was the same as the carrying amount, with the exception of a contingent liability disclosed by HI and relating to a pending legal case. At 1 September 20X3, the contingent liability was independently valued at $1.2 million.

At the current year end, 31 March 20X5, the legal case is still outstanding. The fair value of the liability has now been estimated at $1.4 million, and the case is expected to be resolved in the forthcoming financial year.

How should this contingent liability be recorded in the consolidated financial statements for the year ended 31 March 20X5?

When preparing a consolidated statement of cash flows, which of the following describes the correct presentation of an associate's dividends?

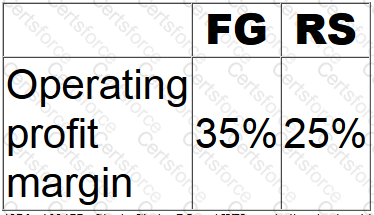

FG and RS operate in the same retail sector within the same country and are of a similar size. The following ratios have been calculated based on the financial statements for the year ended 30 September 20X4:

Which of the following factors would limit the usefulness of these ratios as a basis for assessing the comparative performances of FG and RS?

BC are currently seeking to establish an accounting policy for a particular type of transaction.

There are four alternative ways in which this transaction can be treated. Each treatment will have a different outcome on the financial statements as follows:

• Treatment one means that the financial statements will be easier to prepare.

• Treatment two will give a fair representation of the transaction in the financial statements.

• Treatment three will maximise the profit figure presented in the financial statements.

• Treatment four means that the financial statements will be more easily understood by shareholders.

Which accounting treatment should BC adopt?

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

XY owned 60% of the equity share capital of AB at 1 January 20X6. XY acquired a further 20% of AB's equity share capital on 31 December 20X6 for $500,000. The non controlling interest in AB was measured at $720,000 immediately prior to the 20% acquisition.

Calculate the amount that XY debited to non controlling interest when it accounted for the 20% acquisition in its consolidated financial statements at 31 December 20X6.

Give your answer to the nearest $000.

$ ? 000

The dividend yield of ST has fallen in the year to 31 May 20X5, compared to the previous year.

The share price on 31 May 20X4 was $4.50 and on 31 May 20X5 was $4.00. There were no issues of share capital during the year.

Which of the following should explain the reduction in the dividend yield for the year to 31 May 20X5 compared to the previous year?

LM acquired 80% of the equity shares of ST when ST's retained earnings were $50 million. The fair value of the net assets of ST included a contingent liability with a fair value of $100 million at the date of acquisition and a fair value of $40 million at 31 December 20X6. No other fair value adjustments were required at the date of acquisition.

LM and ST had retained earnings of $200 million and $80 million respectively at 31 December 20X6.

The consolidated retained earnings of LM at 31 December 20X6 were:

ST has sold its main office property, which had a carrying value of $360,000, to AB, a property management entity.

The property was sold for $400,000 which is equal to its fair value and was immediately leased back under an operating lease agreement.

Which of the following journals will record this transaction?

W and Y are very similar entities with the same level of profit before interest and tax. However, W has gearing of 95% and Y has gearing of 30%.

Which of the following statements is true?