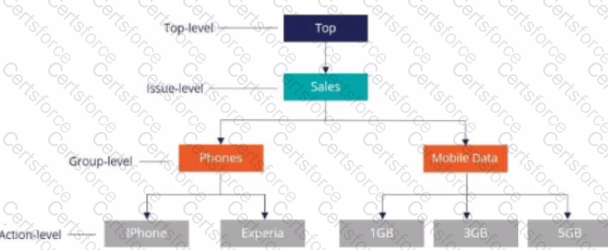

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning architect, what do you configure to select the best offer from both groups based on customer behavior?

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website. What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

U+ Bank implemented a customer journey for its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

MyCo, a telecom company, wants to introduce a new group of offers called Tablets for all customers. As a decisioning architect, which two valid actions do you create? (Choose Two)

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer. U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

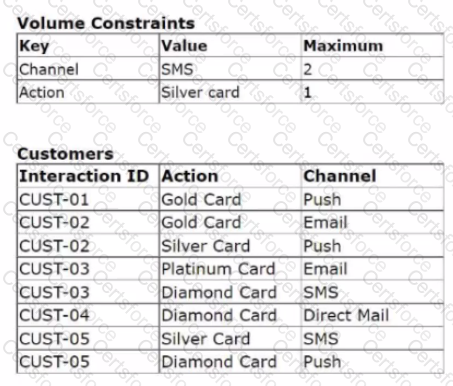

A volume constraint uses the Return any action that does not exceed

constraint mode. The following tables show the configuration of the volume constraints and the list of customers in the outbound segment:

The outbound run selects customers in the following order to apply the volume constraints: CUST-01, CUST-02, CUST-03, and CUST-05.

Based on the configuration of the volume constraints for each channel, which offer does CUST-05 receive?

U+ Bank wants to offer a Gold credit card to customers who have an annual income of more than USD150000. What do you configure in the Next-Best-Action Designer to achieve this outcome7

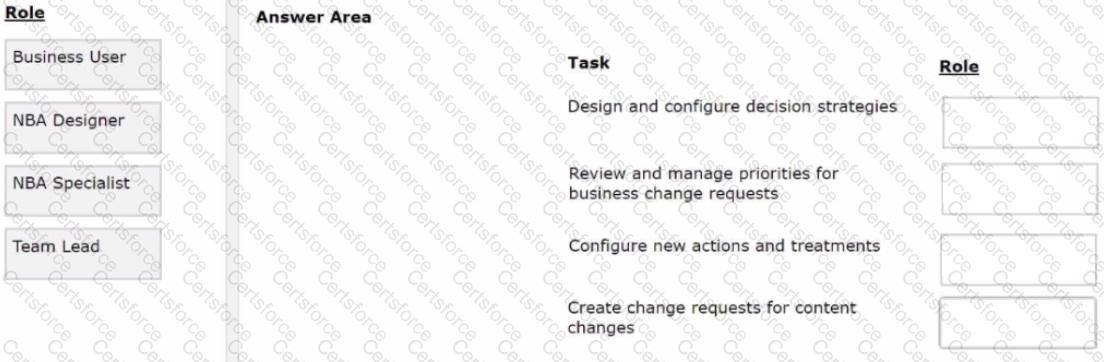

U+ Bank, a retail bank, uses the Business Operations Environment to perform business changes. The team members of the Business Content team and Enterprise Capabilities team perform several roles in the change management process.

Select each role on the left and drag it to the task descriptions to which the role corresponds on the right.

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?