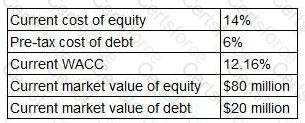

TTT pic is a listed company. The following information is relevant:

TTT pic's board is considering issuing new 6% irredeemable debt to re-purchase equity. This is expected to change TTT pic's debt to equity mix to 40: 60 by market value. The corporate tax rate is 20%.

What will be TTT pic's WACC following this change in capital structure?

A company is deciding whether to offer a scrip dividend or a cash dividend to its shareholders.

Although the company has excellent long-term growth prospects, it is experiencing short-term profit and cash flow problems.

Which of the following statements is most likely to be a reason for choosing the scrip dividend?

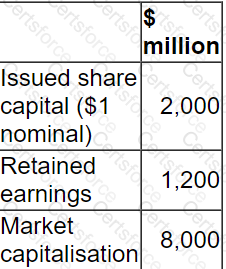

A company's Board of Directors wishes to determine a range of values for its equity.

The following information is available:

Estimated net asset values (total asset less total liabilities including borrowings):

• Net book value = $20 million

• Net realisable value = $25 million

• Free cash flows to equity = $3.5 million each year indefinitely, post-tax.

• Cost of equity = 10%

• Weighted Average Cost of Capital = 7%

Advise the Board on reasonable minimum and maximum values for the equity.

The primary objective of a public sector entity is to ensure value for money is generated.

Value for money is defined as performing an activity so as to simultaneously achieve economy, efficiency and effectiveness

Efficiency is defined as:

Which of the following explains an aim of integrated reporting in accordance with The International

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

Company U has made a bid for the entire share capital of Company B.

Company U is offering the shareholders in Company B the option of either a share exchange or a cash alternative.

Advise the shareholders in Company B which THREE of the following would be considered disadvantages of accepting the cash consideration?

Company ABC is planning to bid for company DDD, an unlisted company in an unrelated industry sector to ABC.

The directors of ABC are considering a number of different valuation methods for DDD before making a bid.

Which of the following is the MOST appropriate method for ABC to use to value DDD?

A company has a covenant on its 5% long term corporate bond.

• Covenant - The earnings must not fall below $7 million

The bond has a nominal value of $60 million.

It is currently trading at 80% of its nominal value.

The projected earnings before interest and taxation for next year are $11.5 million.

The company retains 80% of its earnings. It pays tax at 20%.

Advise the Board of Directors which of the following covenant conditions will apply next year?