JAG and ZEB are two listed companies. JAG is approximately 20 times the size of ZEB.

10 days ago JAG made a hostile bid for ZEB. offering a share exchange.

The bid price represents a 10% profit to the shareholders of ZEB at today's market prices to reflect the high levels of synergistic benefits that JAG expects to realise from the transaction.

Which of the following is the greatest future threat to the post-transaction value for JAG?

An all equity financed company reported earnings for the year ending 31 December 20X1 of $8 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 4%.

The company pays corporate income tax at 20%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

Company A has a cash surplus.

The discount rate used for a typical project is the company's weighted average cost of capital of 10%.

No investment projects will be available for at least 2 years.

Which of the following is currently most likely to increase shareholder wealth in respect of the surplus cash?

WW is a quoted manufacturing company. The Finance Director has addressed the shareholders during WW's annual general meeting-She has told the shareholders that WW raised equity during the year and used the funds to repay a large loan that was maturing, thereby reducing WW's gearing ratio

At the conclusion of the Finance Director's speech one of the shareholders complained that it had been foolish for WW to have used equity to repay debt The shareholder argued that the Modigliani and Miller model (with tax) offers proof that debt is cheaper than equity when companies pay tax on their profits.

Which THREE arguments could the Finance Director have used in response to the shareholder?

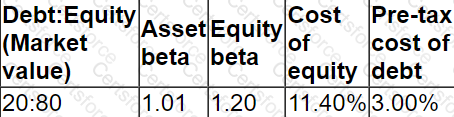

The following information relates to Company A's current capital structure:

Company A is considering a change in the capital structure that will increase gearing to 30:70 (Debt:Equity).

The risk -free rate is 3% and the return on the market portfolio is expected to be 10%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.

Which THREE of the following statements are correct in respect of the issuance of debt securities.

A company has identified potential profitable investments that would require a total of S50 million capital expenditure over the next two years The following information is relevant.

• The company has 100 million shares in issue and has a market capitalisation of S500 million

• It has a target debt to equity ratio of 40% based on market values This ratio is currently 30%

• Earnings for the current year are expected to be S1 00 million

• Its last dividend payment was $1 per share One of the company's objectives is to increase dividends by at least 10% each year

• The company has no cash reserves

Which of the following is the most suitable method of financing to meet the company's requirements?

A company is considering hedging the interest rate risk on a 3-year floating rate borrowing linked to the 12-month risk-free rate.

If the 12-month risk-free rate for the next three years is 2%, 3% and 4%, which of the following alternatives would result in the lowest average finance cost for the company over the three years?

A company has some 7% coupon bonds in issue and wishes to change its interest rate profile.

It has decided to do this by entering into a plain coupon interest rate swap with it's bank.

The bank has quoted a swap rate of: 6.0% - 6.5% fixed against LIBOR.

What will the company's new interest rate profile be?

A company plans to acquire new machinery.

It has two financing options; buy outright using a bank loan, or a finance lease.

Which of the following is an advantage of a finance lease compared with a bank loan?