Section C (4 Mark)

Tom dies in January of the current year and leaves his wife Jeanne a $50,000 insurance policy. Jeanne elects to receive the proceeds at $10,000 per year plus interest, for five years. In the current year, she receives $12,000 ($10,000 plus $2,000 interest).

How much must Jeanne include in her gross income?

Section A (1 Mark)

The inventory turnover ratio and days sales outstanding (DSO) are two ratios that can be used to assess how effectively the firm is managing its assets in consideration of current and projected operating levels.

Section B (2 Mark)

A bank has a limited geographic area. It would like to diversify its loan income with loans in other market areas but does not want to actually make loans in those areas because of their limited experience in those areas. Which type of credit derivative contract would you most recommend for this situation?

Section A (1 Mark)

Riskier stocks have

Section B (2 Mark)

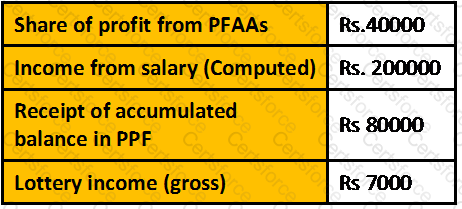

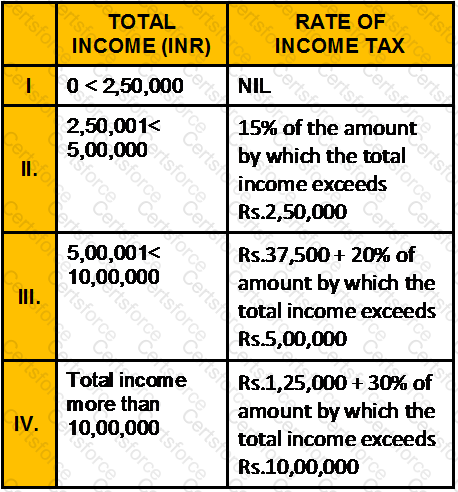

Choose the amount of final tax liability of R for the assessment year 2007-08:

Section A (1 Mark)

Wages for the purpose of gratuity payment as per the Act means

Section A (1 Mark)

Shyam invests in a plan in which he has to pay Rs. 10,000/- per year Starting from the end of 5th year till the end of 12th. How much amount Should he invest today in order to meet his objective. If the interest rate is 10%p.a.?

Section B (2 Mark)

Calculate the duration of a 10 year annual annuity that has a yield of 7%.

Section B (2 Mark)

An analyst expects a firm’s earning per share to grow at 8% per year. If the firm now earns Rs. 3.50 a share, its earnings per share five years from now are expected to be:

Section A (1 Mark)

Comprehensive Wealth Management addresses

Section A (1 Mark)

A financial contract that obligates one party to exchange a set of payments it owns for another set of payments owned by another party is called a

Section A (1 Mark)

_______________ and _______________ mandates are two kinds of service level contracts

Section B (2 Mark)

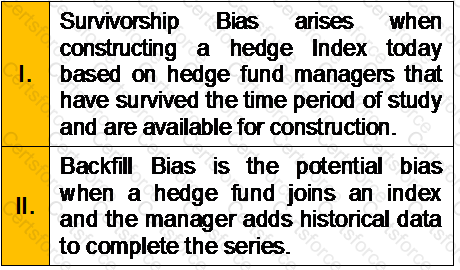

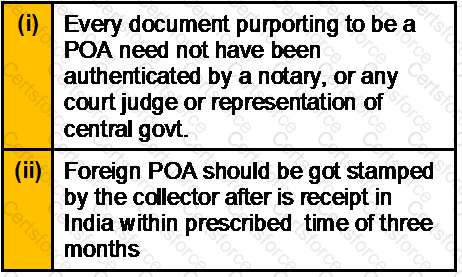

Which of the following statements are true?

Section A (1 Mark)

Which of the following is not normally one of the reasons for a change in an investor's circumstances?

Section B (2 Mark)

A fixed-rate mortgage for Rs210 000 with monthly payments is amortized over 20 years. The interest rate is 4.85% compounded semi-annually for a 7-year term. How much of the mortgage principal has been repaid by the end of the 7-year term?

Section A (1 Mark)

The difference between the cash price and the futures price on the same asset or commodity is known as the

Section B (2 Mark)

Rahul decides to deposit Rs. 5,000/- every month into an account yielding 12 % per annum compounded monthly for 20 years. What will be the accumulated value in this account after 20 years and how much amount can be withdrawn from this account every month for a further period of 20 years of ROI is 8 % per annum compounded monthly?

Section B (2 Mark)

A taxpayer has taxable income for 2011-12 (after deducting the personal allowance) of £185,300. None of the income is derived from savings or dividends. The income tax liability for the year is:

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $ 1,22,300 in US dollars and he is a US citizen (Heads of the households)

• $ 310000 in SGD and he is a citizen of Singapore

Section A (1 Mark)

The life-cycle theory of asset allocation proposes that as investors progress through life, their

Section A (1 Mark)

A loan where the borrower pays interest each period, and repays some or all of the principal of the loan over time is called a(n) _________ loan.

Section C (4 Mark)

At end of this year ICICI Ltd. will pay a dividend on its stock of Rs. 5 per share. The dividend is expected to remain same for next year. During third year dividend is expected to be Rs.6 from there on, the dividend is expected to grow at 5% per year indefinitely. Stocks with similar risk are currently priced to provide a 10% expected return. What is the intrinsic value of ICICI Ltd.

Section A (1 Mark)

The steps to establishing an investment policy are to state the

Section A (1 Mark)

Ideally, clients would like to invest with the portfolio manager who has

Section A (1 Mark)

Mr. Raghav is now 40 years old. He has invested some amount in an annuity which will pay him after 10 years Rs. 30,000/- p.a. at the end of every year for 10 years. Rate of interest is 6% p.a. Calculate how much he has invested today?

Section C (4 Mark)

Yogesh Jain is a Chartered Accountant by profession and a very disciplined investor he has started investing from today in an account Rs. 1,00,000 every year (beginning of year) and plans to increase his contribution by 10% every year. If the ROI he gets is 15% per annum compounded half yearly calculate the corpus he would be able to accumulate in 25 years.

Section A (1 Mark)

A European call option allows the buyer to

Section A (1 Mark)

Disclaimers and assumptions are a part of

Section A (1 Mark)

Wealth Conservation is _____________

Section A (1 Mark)

For a “single income family” priority is on

Section B (2 Mark)

You write one XYZ February 50 put for a premium of Rs5. Ignoring transactions costs, what is the breakeven price of this position?

Section C (4 Mark)

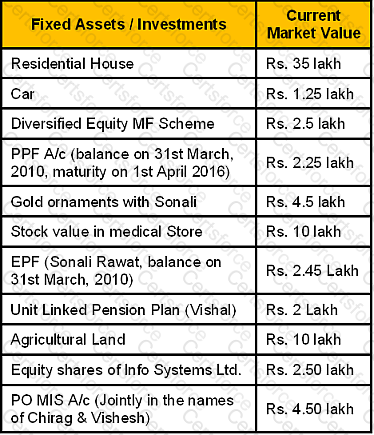

Harish Rawat has approached you on 26th Nov 2010, a Chartered Wealth Manager, for preparing a comprehensive Wealth plan to accomplish his financial goals. From your initial meeting, you have gathered the following information:

Harish Rawat, aged 44 years with life expectancy 70 years, is self-employed in Dehradun. Harish’s wife Sonali, aged 41 years with life expectancy 72 years, is working as a Assistant Manager in a Telecom

Company and is having a post-tax income of Rs. 4 lakh p.a. She is expected to retire at the age of 55 years. The couple has two children Chirag, aged 16 years and Vishesh, aged 10 years. Chirag is studying in 10th standard while Vishesh is studying in 4th standard. Harish’s net annual Income from retail medical store is Rs. 8 Lakh and their monthly household/living expenses, excluding housing loan EMI, are Rs. 32,500.

Harish is a Graduate. He earlier served in a pharmaceutical company as a medical representative for approx. 10 years. After separation from the company, he started his own wholesale business of medicines but could not sustain for long due to lack of working capital. He shut down his operations after 3.5 years. Thereafter he got a contract for retail medical shop in the premises of a nursing home. The terms of the contact are profit sharing in the ratio 50:50. Investment in stock and handling all activities of medical store are of Harish and no rent is charged by the owner of nursing home.

Harish had taken a housing loan of Rs. 15 Lakh disbursed on 1st April 2005. They are presently paying an EMI of Rs. 17,285 at the end of every month beginning from the month of disbursement. The loan is at fixed rate of interest of 11.25% p.a. (reducing monthly balance basis) with tenure of 15 years. Harish has taken a money back insurance plan of 20 year term with sum assured of Rs. 6 Lakh, the annual premium being Rs. 26,250. He has paid 14 annual premiums till date regularly. The policy provides for 20% of the basic sum assured to the insured as survival benefit after 4th, 8th, 12th, 16th years from the start of the policy. He has also taken a Mediclaim family floater policy which covers his spouse and two sons to the extent of Rs. 5 Lakh. He has also paid four regular annual premiums of Rs. 36,000 in a unit linked pension plan and next premium is due on 1st Dec 2010.

Harish’s parents are senior citizens and live in their own house in Haldwani District. Their only source of income is by way of interest received from their joint Senior Citizen Savings Scheme account. Harish’s younger brother, who is also self-employed, is living with his parents.

Harish had invested Rs. 1 lakh to buy 200 shares of a listed company, Mobizox, in the year 2001-02. The Company had issued Bonus shares in the ratio 1:1 in the year 2005-06.Harish also subscribed to the Company’s Rights issue of one share for every four shares held at a price of Rs. 250 per share in Feb 2010. Harish also invested Rs. 4 lakh in an Agriculture land at his native village in Haldwani in 2000-01.

Goals and aspirations

1.To make provision for their children’s higher education expenses at their respective age of 21 years.

2.Such expenses are Rs. 5 lakh for each child at current prices.

3.To make provision for children’s marriage expected at the end of 10 years and 15years from now; presently valued at Rs. 5 lakh each.

4.Build a corpus for his retirement at the age of 58 years

5.To go on vacation with family in January, 2011

Assumptions

1.Inflation is currently 6% p.a. and is likely to remain the same.

2.Risk free interest rate is at 7% p.a.

3.Return on equity MF is 12% p.a.

4.Return on debt MF is 8% p.a.

5.Cost Inflation index is 281 for 1995-96, is 406 for 2000-01, is 463 for 2003-04, is 551for 2007-08, is 582 for 2008-09 and is 632 for 2009-10.

Section B (2 Mark)

Regular collateralized debt obligations (CDO) have been surpassed by:

Section A (1 Mark)

In Working Capital Finance, what should be the minimum current ratio the borrower needs to ensure the compliance under the first method of lending.

Section C (4 Mark)

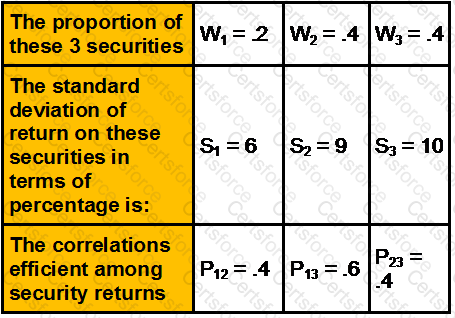

A portfolio consists of 3 securities.

What is the standard deviation of the portfolio?

Section A (1 Mark)

Which of the following will be specifically considered while assessing a property and establishing comparisons with other properties?

Section A (1 Mark)

Which of the following is least indicative of the pyramid structure seen when individuals create portfolios?

Section B (2 Mark)

Which of the following is a reasonable assumption to make about the understanding of a client on the Wealth planning Process?

Section C (4 Mark)

Saurabh contributes Rs. 10,000 every year starting from the end of the 5th year from today till the end of 12th year in the account that gives a ROI of 7.75% p.a. compounded half yearly. Calculate the Present Value of his contribution today.

Section B (2 Mark)

A stock with a Beta of 0.7 currently priced at Rs 50 is expected to increase in price to Rs 55 by year end and pay Rs 1 as dividend. The expected market return is 15% and the risk free rate is 8%. The stock is:

Section A (1 Mark)

Cash Flow is a tool that is more useful for

Section A (1 Mark)

In US which group is unlikely to support tax limitations?

Section C (4 Mark)

A 14% semiannual-pay coupon bond has six years to maturity. The bond is currently trading at par. Using a 25 basis point change in yield, the effective duration of the bond is closest to:

Section A (1 Mark)

A swap that involves the exchange of one set of interest payments for another set of interest payments is called a(n)

Section A (1 Mark)

Which of the following statements about Real Estate Investment Trusts is/are true?

Section C (4 Mark)

Nifty is presently at 2694. Mr. XYZ expects Nifty to fall. He buys one Nifty ITM Put with a strike price Rs. 2800 at a premium of Rs. 132 and sells one Nifty OTM Put with strike price Rs. 2600 at a premium Rs. 52.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2359

• If Nifty closes at 3561

Section B (2 Mark)

Which of the following statement is/are correct?

Section A (1 Mark)

NSSO stands for ____________

Section B (2 Mark)

Which of the following statements is/are correct with respect for Resident Senior Citizen i.e. who is of an age of 60 years and above, but below 80 years?

Section B (2 Mark)

Rakesh owes Rs. 10000 to Haresh who transfers the debt amount to Chirag. Haresh then demands the same from Rakesh, who does not have a notice of the transfer as per section 131 but still pays to Haresh. This payment is invalid &Chirag can sue Rakesh for the debt