Mr. Sumit is an employee of Genesis Ltd. His basic pay is Rs.24,000 p.a., Dearness Allowance Rs.12,000 p.a; Medical Allowance (fixed) Rs.10,000 p.a.; Conveyance Allowance Rs.6,000 p.a.; Professional Tax deducted from his salary Rs.1,000 p.a.; Free lunch provided during office hours valued at Rs.12,000 for a 300-working day year; free education for two children in a school owned and maintained by the employer – school tuition fee for both the children is estimated at Rs.18,000 p.a.

What is Net Income of Mr. Sumit and examine whether he is a specified or non-specified employee?

Deduction under section 80RRB is allowed to the extent of:

Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable

Mr. Sumit has worked in a PSU for 14 years 7 months. His Terminal Wages are Rs. 45,000. He wants to know the Gratuity amount payable to him (assuming that he leaves the service today). It is_____________

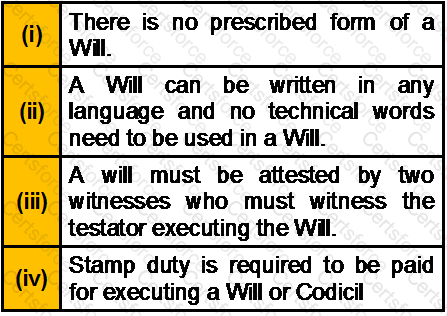

Which of the following statement(s) about Will is/are correct?

Which is not the condition for getting superannuation fund approved?

Lokesh purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-. As a CTEP calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

The income of any university or other educational institution existing solely for educational purposes and not for the purposes of profit is exempt under clause (iiiad) of Section 10(23C) if the aggregate annual receipts’ of such university or educational institution do not exceed

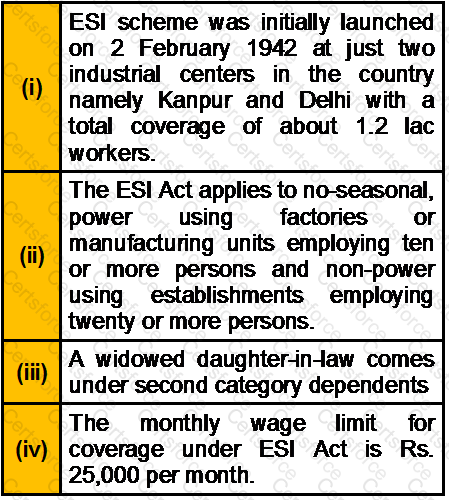

Which of the following statement(s) about Employee State Insurance Act is/are correct?

In ____________ the parties have the right to withdraw from the contract as long as the parties do not leave the place of contract. In___________ the buyer could cancel the sale if the seller has sold the goods at price higher than the market price.