A company manufactures two products Product X and Product Y, during a joint process Product Y canoe processed further to create Product Z Relevant data are shown below.

Genco Healthcare has asked ns controller to summarize the company’s financial performance for the past two years. The accountant provided the following two years financial ratios for reference.

Which one of the following statements regarding working capital management is not correct?

A company is considering investing £1 million for a new machine. The new machine is expected to generate £450,000 incremental before-tax operating cash inflows and £100.000 in additional depreciation expense for each of the next ten years. The company uses the same depreciation assumptions tor book and tax purposes. If the company's income tax rate is 30%, what is the change in the yearly after-tax cash flow from operations if the company invests in the new machine?

Given the financial information shown below, what amounts would be shown for sales revenue and for gross prom, respectively in a common size income statement?

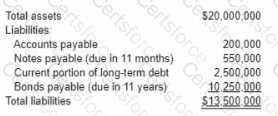

Marlow Company s partial balance sheet indicated the following.

It is possible to eliminate risk in a two-stock portfolio of common stocks if

SSA inc. issues 4% bonds with a lace value of $500,000 when the market rate of interest is 3% for similar bonds. The bonds mature in 10 years, and pay interest every six months. Which one of the following is closest to the amount of cash SSA will receive upon issued.

The human resources manager of BankUS has noted mat me company s employee turnover has increased. He has also had his budget cut, and will have to reduce training for new associates. He has a meeting scheduled with the CFO lo go over risks that his department faces. What should the human resources manager tell the CFO about risk?

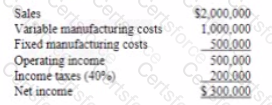

Calculate AMI’s degree of operating leverage. Show your calculations.

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.