An investigator is reviewing an alert for unusual activity. System scanning detected a text string within a company customer's account transactions that indicates the account may have been used for a drug or drug paraphernalia purchase Based on the KYC profile, the investigator determines the customer's company name and business type are marketed as a gardening supplies company. The investigator reviews the account activity and notes an online purchase transaction that leads the investigator to a website that sells various strains of marijuana. Additional account review detects cash deposits into the account at the branch teller lines, so the investigator reaches out to the teller staff regarding the transactions. The teller staff member reports that the business customers have frequently deposited cash in lower amounts. The teller, without prompting, adds that one of the transactors would occasionally smell of a distinct scent of marijuana smoke.

Which are the best next steps for the investigator to take? (Select Three.)

A SAR/STR regarding money-mule activity prompts law enforcement action. Under U.S. law, the alleged money mules can be prosecuted:

How does the Financial Action Task Force (FATF) measure the effectiveness of a country's efforts to combat money laundering and terrorist financing?

Which scenarios are common to money laundering through online marketplaces and trade-based money laundering? (Select Two.)

Which is the first valid step in the Mutual Legal Assistance Treaties international cooperation process?

A compliance officer of a financial institution is reviewing a payment for sanctions compliance between two parties in Europe and Asia. The payment is in Euros and involves the provision of services to a company located in a jurisdiction subject to Office of Foreign Assets Control secondary sanctions. Which factor is most important in determining the compliance officer's response?

CLIENT INFORMATION FORM Client Name: ABC Tech Corp Client ID. Number: 08125 Name: ABC Tech Corp Registered Address: Mumbai, India Work Address: Mumbai, India Cell Phone: "*•"'" Alt Phone: "*""* Email: ........"

Client Profile Information:

Sector: Financial

Engaged in business from (date): 02 Jan 2020 Sub-sector: Software-Cryptocurrency Exchange Expected Annual Transaction Amount: 125,000 USD Payment Nature: Transfer received from clients’ fund

Received from: Clients

Received for: Sale of digital assets

The client identified itself as Xryptocurrency Exchange." The client has submitted the limited liability partnership deed. However, the bank's auditing team is unable to identify the client's exact business profile as the cryptocurrency exchange specified by the client as their major business awaits clearance from the country's regulator. The client has submitted documents/communications exchanged with the regulator and has cited the lack of governing laws in the country of their operation as the reason for the delay.

During the financial crime investigation, the investigator discovers that some of the customer due diligence (CDD) documents submitted by the client were fraudulent. The investigator also finds that some of the information in the financial institution's information depository is false. What should the financial crime investigator do next?

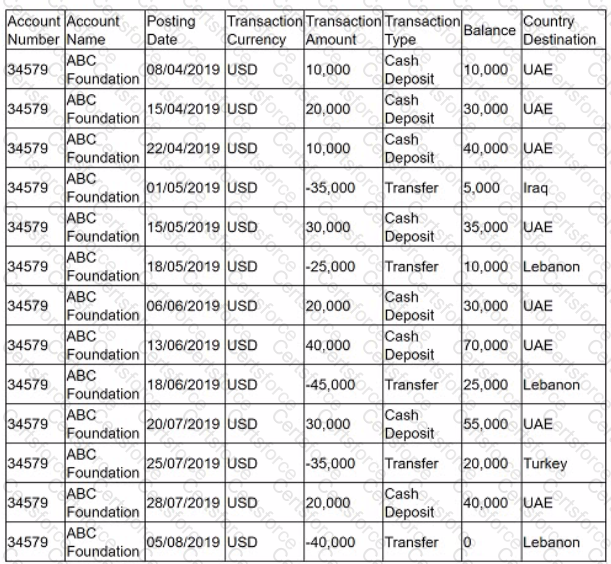

Each month the automated transaction monitoring system generates alerts based on predetermined scenarios. An alert was generated in relation to the account activity of ABC Foundation. Below is the transaction history for ABC Foundation (dates are in DD/MM/YYYY format).

The relationship manager for ABC Foundation contacts the client to request more information on the beneficiary of the transfer in Turkey. ABC Foundation advises that this is a not-for-profit charity group called 'Forever Free." Which is the best next step in the investigation?

The training department is conducting awareness training for unusual customer identification scenarios. Which two indicators should be included? (Select Two.)

Which most likely indicates that a business email compromise attack has occurred?