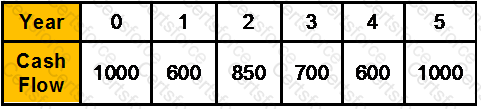

What is the present value of the following cash flows,if the Interest rate is 8%?

Sunil, aged 33 years, is having a policy of Rs. 1 Lac sum assured and is paying premium of Rs. 1,800/- for the last 10 years. The cash surrender value of this policy is at the end of previous year was Rs. 20,000. It is estimated that by this year end, the cash surrender value of this policy would be Rs. 22,900.

There is another term insurance of sum assured of Rs. 80,000 costs Rs. 300/- per annum which is available to him . If rate of interest is 6%, then first calculate the CPT of existing and new policy respectively and then advise Sunil if it is better to continue this policy or to discontinue it?

Vinod Khanna, aged 27 years, is having a policy of Rs. 15 Lac sum assured and is paying premium of Rs. 14,800/- . The cash surrender value of this policy is at the end of previous year was Rs. 35,000. It is estimated that by this year end, the cash surrender value of this policy would be Rs. 40,000/-. Bonus under this old policy is Rs. 10,000/-.

There is another term insurance policy of Rs. 15 Lac Sum Assured is available to Vinod at Rs. 4,200/- per annum. If rate of interest is 8 % then first calculate the CPT of existing and new policy respectively and then advise Vinod if it is better to continue this policy or to discontinue it?

Which of the following option illustrates an advantage of the probate process?

The current dividend on an equity share of MAGADH Limited is Rs.8.00 on earnings per share of Rs. 30.00. Assume that the growth rate of 20 percent will decline linearly over a five year period and then stabilize at 12 percent. What is the intrinsic value of MAGADH ’s share if the investors’ required rate of return is 15 percent?

How much amount should be invested by Mr. Batra today to get a maturity value of Rs. 90,368.50 after 6 years, if available ROI is 10% and compounding is Quarterly for first 2 years, Half Yearly for next 2 years and Monthly for last 2 years?

"Consider the following information for three stocks, Stock A, Stock B, and Stock C. The returns on each of the three stocks are positively correlated, but they are not perfectly correlated.

Portfolio X has half of its funds invested in Stock A and half invested in Stock B. Portfolio Y has invested its funds equally in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium.

Which of the following statements is/are correct?

A stock caries the following returns over a five year period:

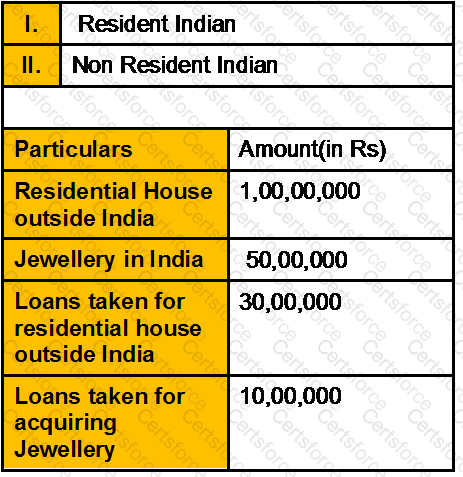

From the following information of assets assets and liabilities, the taxable wealth for:

Mr. Bose runs his Handicrafts business. His net proceeds after deducting both the business expenses and living expenses are Rs. 6,00,000 p.a, which will increase at the rate of 5%. He is a bachelor and don’t intend to start any family in future either. Since he don’t have any family obligations, he wants to sell off his business after ten years and buy a home in foothills of Himachal.

He expects to sell the business for a good amount and put 40% of the proceeds in buying the house and setting up a retirement corpus with the rest of amount to pay off his post retirement expenses. He is philanthropic by nature and thus want to save the net revenues from his business to form a charitable hospital for poor people living in Himachal. His current living expenses are Rs. 4,00,000 p.a which will increase in line with inflation. Inflation rate is 3% and interest rate prevailing is 6%.

As a CWM you are required to calculate:

Mahesh earns 1,20,000 pa. He has total debt of Rs. 2,00,000 and have two dependants. Interest rate is 7%, and assumes 80% of his pre-death salary is the estimated requirement to maintain his family after paying the loan. Calculate the life insurance cover needed under multiple approach method.

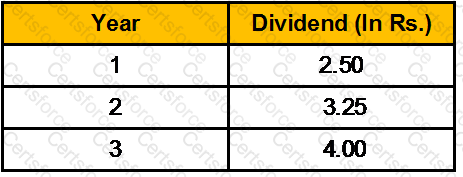

Management has recently announced that expected dividends for the next three years will be as follows:

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Mr. Chopra runs a Garment Factory, he is very concerned about his retirement and wants you to help him out in planning for it. His Current annual expenses are Rs. 12,00,000 which would be rising at an annual rate of 8% pre- retirement and 2% post retirement. His current age is 50 years and he wants to work till the age of 65. The expected life expectancy in his family is 75 years. Calculate the monthly contribution he must make till his retirement if the pre- retirement returns are 12% p.a. compounded monthly and post-retirement returns are 8% pea compounded annually.?

Jaya is the owner of two residential houses. She sold one house on 23-12-2011 for Rs.12,50,000 which was purchased by her on 25-4-1979 for Rs.80,000. The market value of the land as on 1-4-1981 was Rs.98,000. Expenses on transfer were 1.5% of the sale price. The entire sale proceeds was utilized to construct the first and second floor on her second house which she completed by 15-3-2010. Compute the capital gain for the assessment year 2012-13. [CII-12-13: 852,11-12: 785, 10-11:711, 83-84: 116]

Smt. Rajalakshmi owns a house property at Adyar in Chennai. The municipal value of the property is Rs. 5,00,000, fair rent is Rs. 4,20,000 and standard rent is Rs. 4,80,000. The property was let-out for Rs. 50,000 p.m. up to December 2010. Thereafter, the tenant vacated the property and Smt. Rajalakshmi used the house for self-occupation. Rent for the months of November and December 2010 could not be realized in spite of the owner's efforts. She paid municipal Texas @12% during the year. She had paid interest of Rs.25,000 during the year for amount borrowed for repairs for the house property. Compute her income from house property for the A.Y. 2012-13.

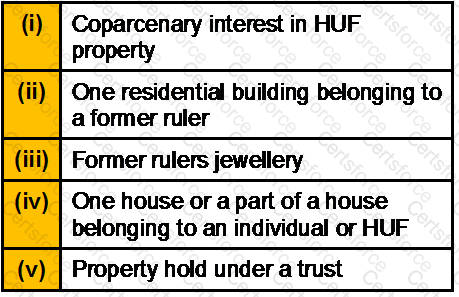

Which assets are totally except from wealth tax?

Ms. Sonali Briganza is 22 years old. She is currently earning a salary of Rs.5,00,000/- per annum and saves 20% of her salary every year. If her salary increases by 10% every year and she is able to get a return of 11% p.a. compounded annually throughout her investment horizon what would be the corpus of funds available at her age 58.?

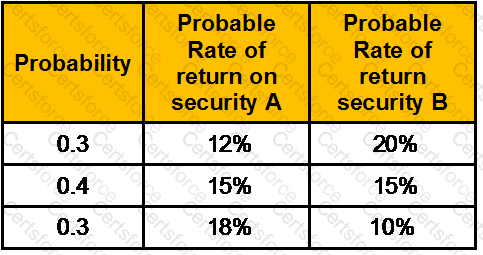

Given the following information what is the expected return on the portfolio of two securities where both are held in equal weights?

Mr. Ajay and Vijay both are 30 years old. And both are 30 years away from their retirements. Ajay saves Rs. 10,000/- p.a. for 8 years and stops. Vijay starts investing after Ajay stops and saves Rs. 10,000/- p.a. till he retires. Their savings earn 10% p.a. compounded yearly. At the retirement what is true?

You have a choice between 2 mutually exclusive investments. If you require a 15% return, which investment should you choose?