A financial institution engaged in mortgage lending has embarked on a business process improvement initiative to eliminate the activities that hinder growth to ultimately improve the success rate of its mortgage business. As a benchmark for identification, the institution is keen on improving any business process that has less than a 75% success rate. The institution has appointed a business analyst (BA) to review the business transactions for the processes of origination, payments, and closures, as well as identify opportunities for improvements and recommend solutions.

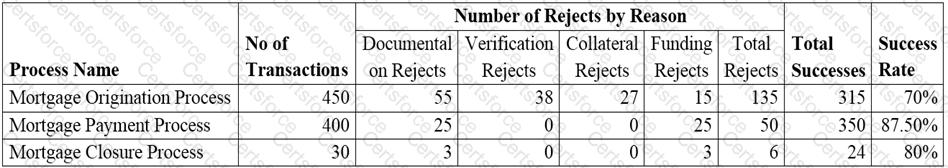

The BA has collected the following information over the last three months pertaining to these business processes:

•All the business processes are at their maximum capacity in terms of the current number of transactions.

•Each business process has a certain number of rejects and the reasons for rejection include documentation, verification, collateral, and funding. Funding rejects occur when the bank's customers have failed to make payment of their mortgage processing fee or mortgage closure payment.

The BA has also recommended the use of documentation checklists as a solution to eliminate the documentation rejects.

If the financial institution always works at full capacity month to month and the new success rate continues to remain the same after implementing the BA's recommendation, what is the average number of successes per month for the mortgage closure process, if the current process capability were increased by 50%?

Submit