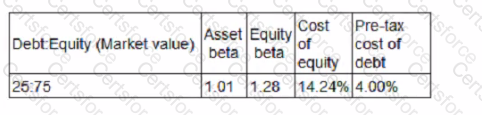

The following information relates to Company ZZA's current capital structure:

Company ZZA is considering a change in the capital structure that will increase gearing to 35:65 (Debt Equity).

The risk-free rate is 4% and the return on the market portfolio is expected to be 12%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.

Submit