Company HJK is planning to bid for listed company BNM

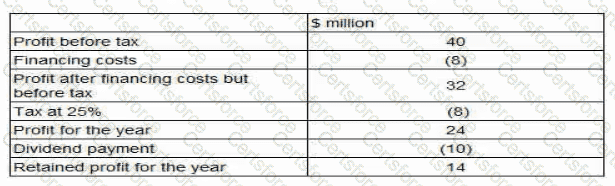

Financial data for BNM for the financial year ended 31 December 20X1:

HJK is not forecasting any growth in these figures for the foreseeable future

Profit and cost data above should be assumed to be equivalent to cash flow data when answenng this question

Which THREE of the following approaches would be most appropriate for HJK to use to value the equity of BNM?

Submit